Quarterly Estimated Tax Dates 2024 In India

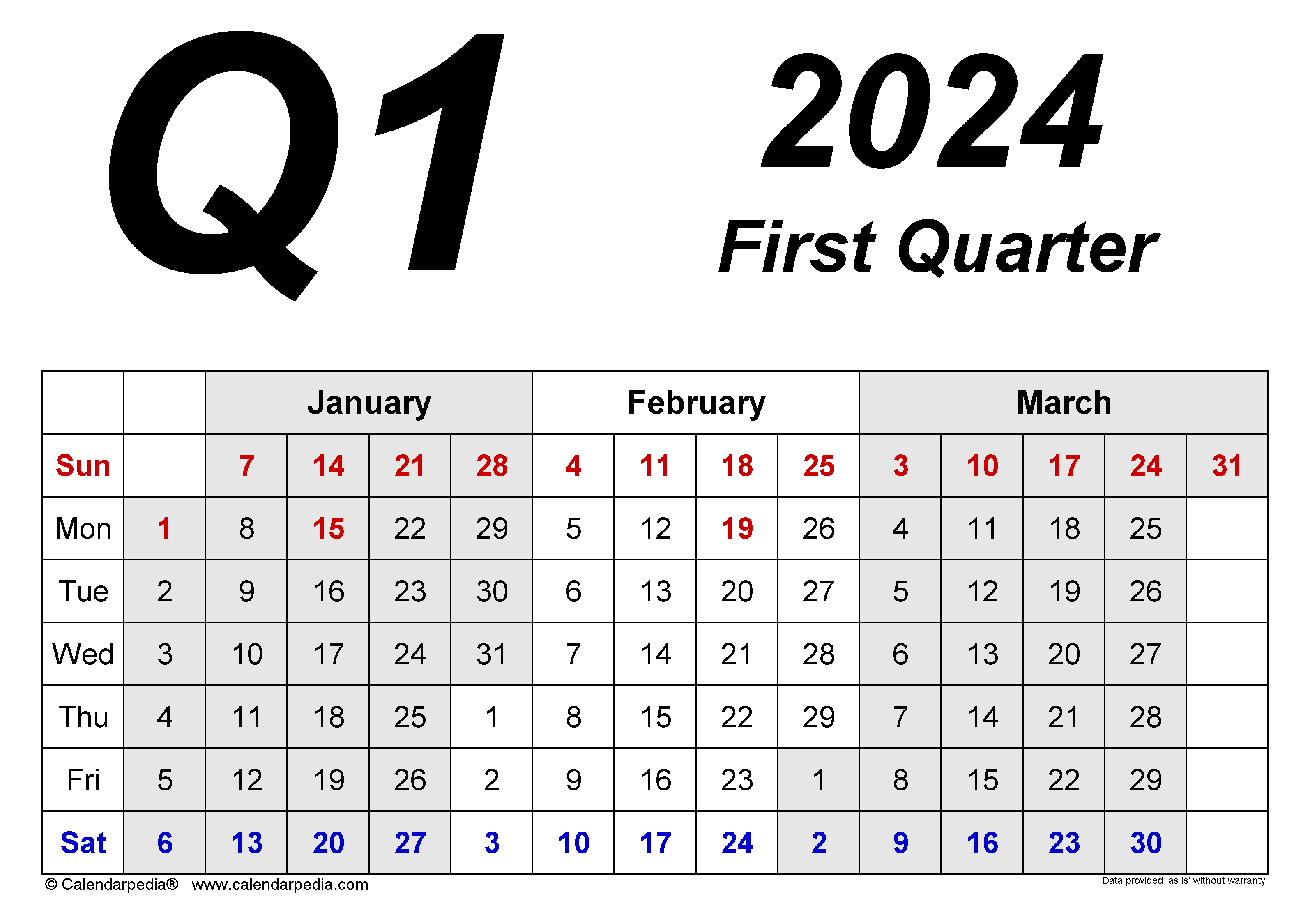

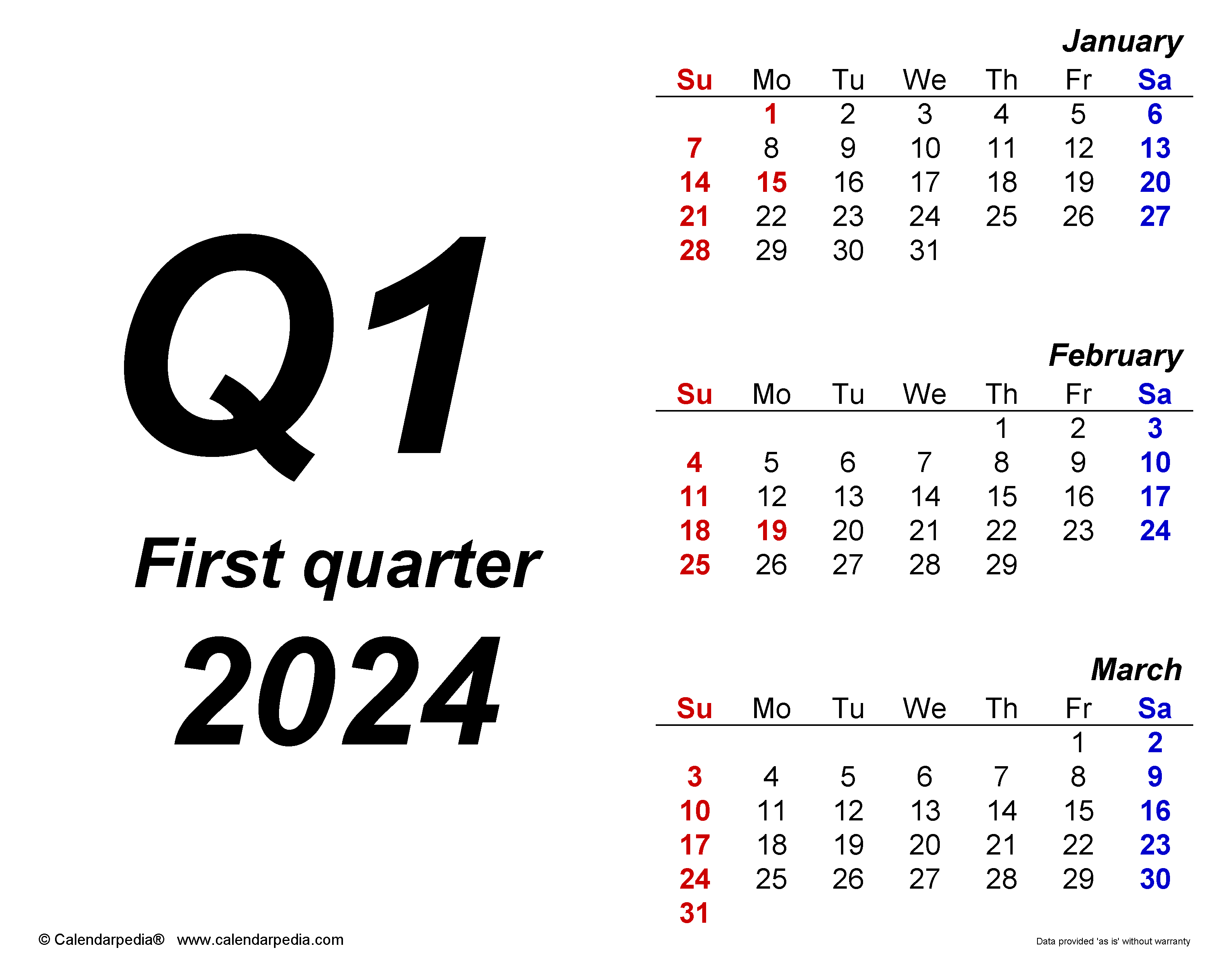

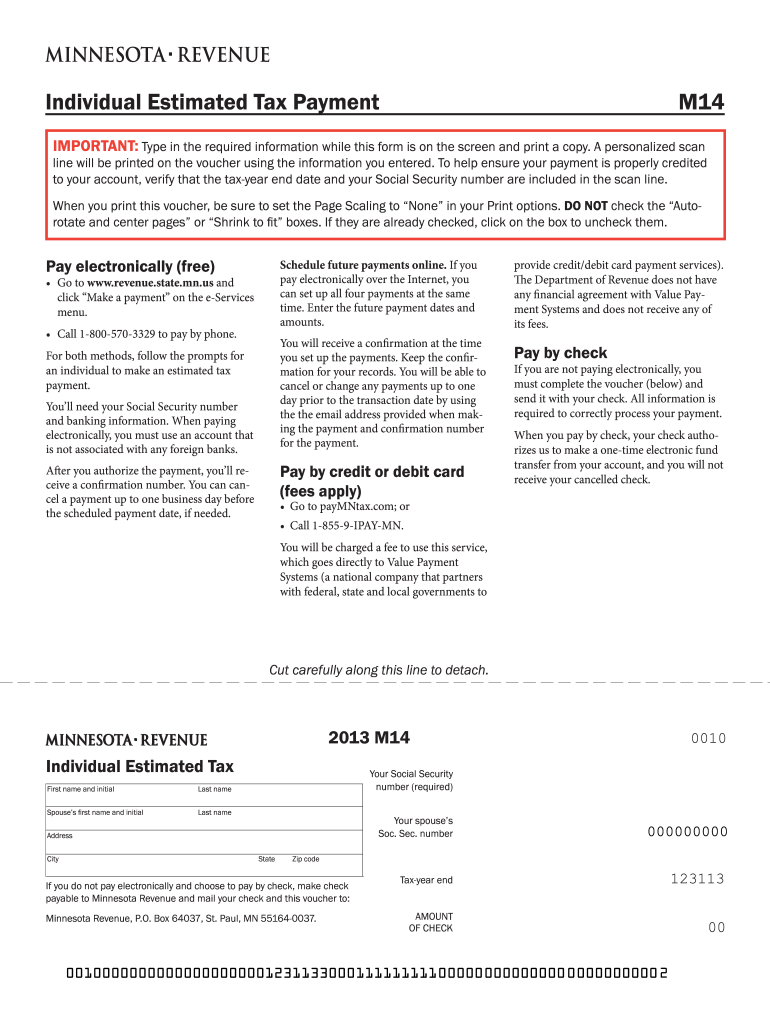

Quarterly Estimated Tax Dates 2024 In India. Estimated tax payments are typically made incrementally, on quarterly tax dates: Taxpayers are required to compute the advance tax by estimating income for the entire year, tax payable on the same and reduce tax already deducted at source.

15 of the following year, unless a due date falls on a weekend or. Here is the income tax calendar for 2024 telling you all the important last dates between january and december 2024.

Quarterly Estimated Tax Dates 2024 In India Images References :

Source: kizziewvinny.pages.dev

Source: kizziewvinny.pages.dev

Estimated Tax Dates 2024 Tybi Lorinda, 31 may 2024 | 2.

Source: milkadonnamarie.pages.dev

Source: milkadonnamarie.pages.dev

Quarterly Tax Payments 2024 Due Dates Hatty Kordula, Due date for deductors to deposit tax.

Source: xeniajacquetta.pages.dev

Source: xeniajacquetta.pages.dev

Quarterly Estimated Tax Payments 2024 Dates Nessi ZsaZsa, July 31 is the last date to file itr.

Source: walliwwavie.pages.dev

Source: walliwwavie.pages.dev

Estimated Quarterly Tax Payment Dates 2024 Lok Kial Selina, January 2024 january 7 :

Source: lucileanna.pages.dev

Source: lucileanna.pages.dev

Estimated Quarterly Tax Payment Dates 2024 Greta Katalin, It covers the period from april 1st, 2024, to march 31st, 2025, with a focus on individuals, professionals, and sme businesses.

Source: jolybgabriela.pages.dev

Source: jolybgabriela.pages.dev

Estimated Tax Payments 2024 Dates Calculator Heda Rachel, Know all the due date extensions at one place!

Source: arianaqmyriam.pages.dev

Source: arianaqmyriam.pages.dev

Pay Estimated Taxes Online 2024 Due Dates Rafa Zsazsa, It covers the period from april 1st, 2024, to march 31st, 2025, with a focus on individuals, professionals, and sme businesses.

Source: emeldabsusannah.pages.dev

Source: emeldabsusannah.pages.dev

Estimated Tax Payments 2024 Online Xena Ameline, The tax is computed on the income earned during the year and is paid in instalments as per the designated due dates.

Source: amybsarette.pages.dev

Source: amybsarette.pages.dev

2024 Estimated Tax Due Dates Forms 2024 Printable Indira Gabriella, Stay updated with deadlines for filings, payments, and more for timely compliance.

Source: audiqconcettina.pages.dev

Source: audiqconcettina.pages.dev

2024 Estimated Tax Payment Due Dates Ambur Phaedra, For the second quarter of 2024.