Fsa 2024 Rollover Amount Irs

Fsa 2024 Rollover Amount Irs

A rollover allows employees to carry over unused fsa funds to the new plan year. The fsa contribution limits, which are set by the irs each year, for the three types of fsas are as follows:

You can carry over up to $610 from your 2023. Fsa contribution limits, expirations and rollovers.

The Irs Has Just Announced Updated 2024 Fsa Contribution Limits, Which Are Seeing Modest Increases Over 2023 Amounts.

A rollover allows employees to carry over unused fsa funds to the new plan year.

In 2024 Contributions Are Capped At $3,200, Up From $3,050 In 2023.

If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules).

Images References :

Source: minettewted.pages.dev

Source: minettewted.pages.dev

Irs List Of Fsa Eligible Expenses 2024 Rorie Claresta, Fsa contribution limits, expirations and rollovers. A rollover allows employees to carry over unused fsa funds to the new plan year.

Source: xylinawolva.pages.dev

Source: xylinawolva.pages.dev

Rollover Fsa 2024 Suzy Zorana, Each year the irs allows you to put a maximum amount of money into your fsa. The health care (standard or limited) fsa annual maximum plan contribution limit is projected to increase from $3,050 to $3,200 in 2024.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health reimbursement arrangements (hra),. The consolidated appropriations act, 2021 (caa), signed into law near the end of 2020, gives employers the option to allow participants to roll over all unused.

Source: austinqagnesse.pages.dev

Source: austinqagnesse.pages.dev

2024 Fsa Limits Irs Contribution Dede Sydelle, If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules). The employer decides how much can be rolled over per plan year (up to the irs.

Source: www.retirementplanblog.com

Source: www.retirementplanblog.com

IRS issues updated Rollover Chart The Retirement Plan Blog, In 2023, you can carry over up to $610 if your employer allows it. If your employer offers a rollover, the irs permits you to carry over a set amount of unspent funds (indexed annually, per irs rules).

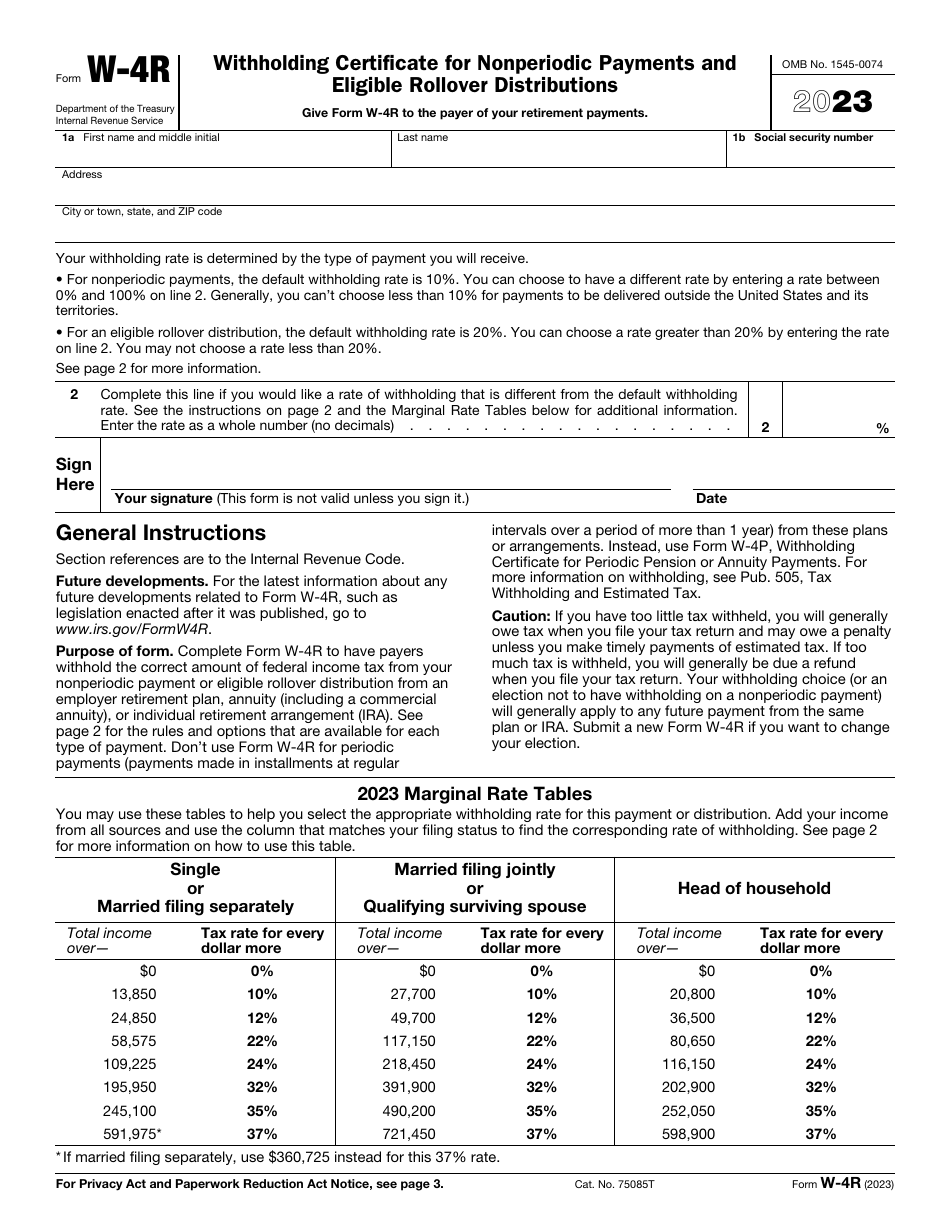

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form W4R Download Fillable PDF or Fill Online Withholding, It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside. Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2024 versus the current maximum of $610.

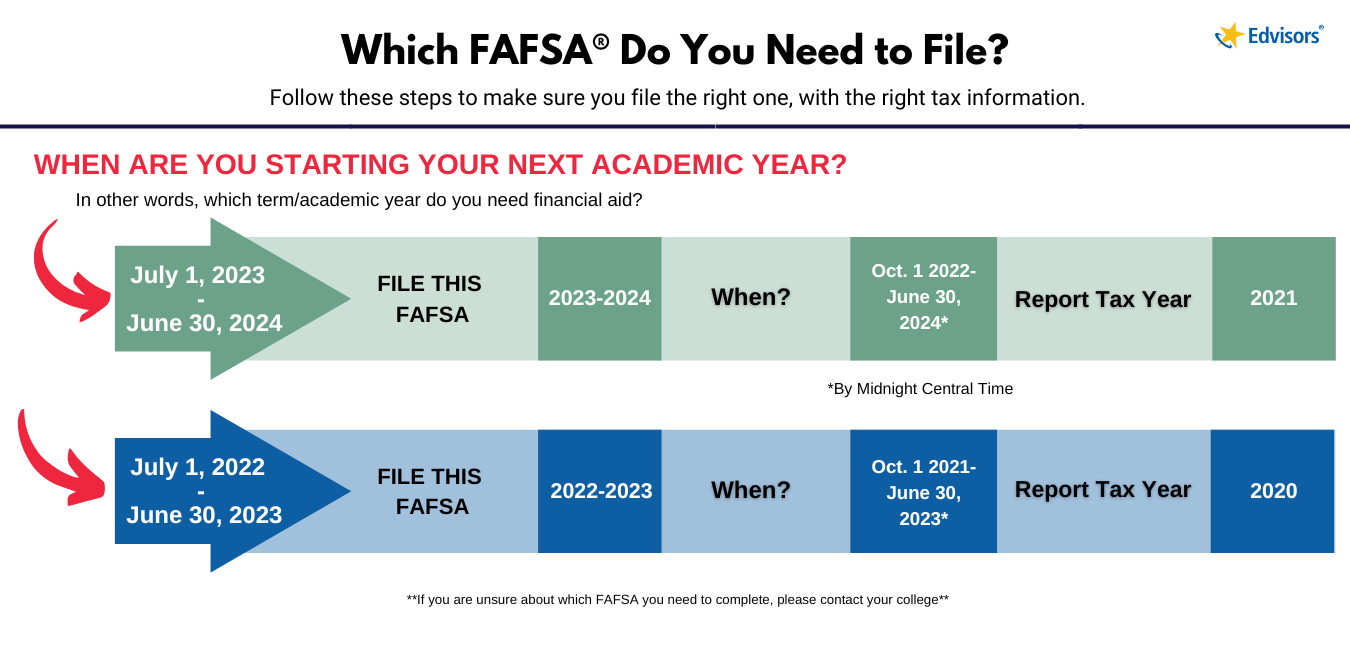

Source: printableformsfree.com

Source: printableformsfree.com

Fafsa Form For 2023 2024 Printable Forms Free Online, In 2024 contributions are capped at $3,200, up from $3,050 in 2023. My understanding is new contribution is for 2024, rollover (leftover) amount is for 2023.

Source: www.youtube.com

Source: www.youtube.com

IRS change to FSA rules significantly decreases carryover amount; here, It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside. Each year the irs allows you to put a maximum amount of money into your fsa.

Source: www.cu.edu

Source: www.cu.edu

Dependent Care FSA University of Colorado, The irs has just announced updated 2024 fsa contribution limits, which are seeing modest increases over 2023 amounts. You can carry over up to $610 from your 2023.

Source: bceweb.org

Source: bceweb.org

Rollover Rules Chart A Visual Reference of Charts Chart Master, In 2023, you can carry over up to $610 if your employer allows it. A rollover allows employees to carry over unused fsa funds to the new plan year.

Amounts Contributed Are Not Subject To Federal Income Tax, Social Security Tax Or Medicare Tax.

The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024.

A Rollover Allows Employees To Carry Over Unused Fsa Funds To The New Plan Year.

For plan years beginning in 2025, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement.

Posted in 2024